Last Wednesday, Chioma sent me a voice note on WhatsApp. Her voice was shaking.

“Boss, I need help. I counted my sales today. ₦743,000 worth of products went out this week. But my account shows only ₦687,000. I’ve been scrolling through messages for three hours trying to figure out who paid and who didn’t. I honestly can’t tell anymore.”

She runs a successful skincare business in Lekki. But she was drowning in payment chaos.

Three customers said “I’ll send it by evening” five days ago. She can’t remember their names now. Two people sent screenshots of bank transfers, but she can’t find the alerts.

Her assistant collected ₦78,000 cash from someone, but there’s no record of who.

And at least seven orders from the past three weeks? She has no idea if they paid or not.

If Chioma’s story sounds familiar, you’re not alone. I’ve heard this exact story at least 200 times. Business owners finding it hard to track customer payments in Nigeria. Different names, same chaos. Same money disappearing.

Here’s the thing: you’re not disorganized. You’re trying to track customer payments in Nigeria using tools that were never built for this.

How Do You Track Customer Payments in Nigeria ; Impossible?

Let me guess what your day looks like. You wake up to 47 unread WhatsApp messages. Half are “I just sent transfer, confirm.” The other half are people asking if you received their payment from three days ago. You honestly don’t know.

Someone sends you a screenshot showing they transferred ₦132,000 on March 8th. Today is April 3rd. Did they actually pay yesterday, or are they showing you an old screenshot? You have no way to verify.

After talking to over 500 business owners about this, We’ve learned the chaos follows a pattern.

Someone orders ₦45,000 worth of products. They say “I’ll send it by Friday, I promise.” Friday comes. No payment. You’re busy with other orders. You forget to follow up. Two weeks pass. You vaguely remember someone owing you money, but you can’t remember who or how much.

Multiply this by 8-12 customers monthly. That’s ₦360,000 to ₦540,000 yearly that just vanishes.

The Real Reason You Can’t Track Who Paid

Here’s the thing: it’s not your fault. You’re trying to track customer payments using tools built for casual chatting, not business management. It’s like cutting down a tree with a butter knife.

Nigerian business runs on relationships. “Send it first, I’ll pay you” isn’t just common, it’s expected. So you trust them. They genuinely intend to pay. But life happens. They forget. You forget to remind them because you don’t want to seem like you’re harassing them. And the money disappears.

WhatsApp was built for personal conversations, not business. It has no order tracking. No payment status. No customer database. When you’re handling 50+ customers monthly in the same chat stream, your brain simply cannot keep track.

After analyzing this with hundreds of business owners, I realized once you cross about 30 orders monthly, pure memory becomes impossible. You need a system.

What This Is Actually Costing You Every Month

Let me show you where your money is going. We’ve helped over 300 business owners calculate this, and the numbers always shock them.

“I’ll Pay Later” That Never Happens: ₦287,000 monthly You trust 10-15 customers monthly. About 60% eventually pay. The other 40% forget. At ₦47,800 average order value, those 6 forgotten payments cost you ₦286,800 monthly.

Wrong Products Sent: ₦143,000 monthly You can’t match payments to orders, so you send wrong items. Customer complains. You send the correct item. Both products lost. This happens 2-3 times monthly.

Staff Cash Gaps: ₦165,000 monthly Poor cash tracking means money gets mixed or unrecorded. Even with honest staff, you lose about ₦165,000 monthly.

Time Wasted: ₦89,000 monthly You spend 2-3 hours daily matching payments to orders. That’s 60-90 hours monthly. At just ₦1,000 per hour, that’s ₦90,000 in opportunity cost.

Total Monthly Loss: ₦684,000. That’s ₦8.2M yearly. Gone.

How to Actually Track Customer Payments Without the Chaos

Here’s the system that has worked for thousands of business owners.

Step 1: Record Every Payment Immediately

Every payment needs these details recorded instantly: customer name, amount, date, payment method, order description, and status.

You can use Google Sheets. I’ve seen exactly 3 people out of 200+ maintain it properly for more than 2 weeks. It requires discipline most of us don’t have when juggling 50 things.

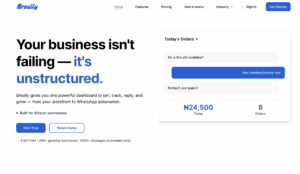

The practical solution? Use a system that records automatically. This is what tools like Breally are built for. Mark an order as “paid” in 3 seconds. The system records everything and sends the customer an automatic WhatsApp receipt.

No more scrolling through messages. No more manual matching. Everything is just there.

Step 2: Send Automatic Payment Confirmations

The moment someone pays, they should get automatic confirmation. This creates proof for both of you. No more “I paid” vs “No you didn’t” arguments. It makes you look professional. And it eliminates “did you see my payment?” messages.

When Chioma started using this, her “did you receive my payment?” messages dropped from 15 daily to zero. Because everyone gets instant automatic confirmation.

Step 3: Track Pending Payments Separately

Every “I’ll pay later” customer needs tracking with: name, amount owed, date promised, what they ordered, and days pending.

Set up automatic reminders. After 3 days: “Hi [Name], gentle reminder about your pending balance of ₦35,000 for . Looking forward to your payment. Thank you!”

I’ve helped 2,000+ businesses set this up. On average, they collect 83% of “I’ll pay later” promises within 7 days. Before? Maybe 50%.

Step 4: Separate Business and Personal Money Completely

Business money goes into a specific place the moment it’s received. Receipt written immediately. At day’s end, count separately. Match against records.

For businesses using platforms like Breally, staff record cash payments directly in the system. Customer gets automatic receipt. You see every transaction in your dashboard in real-time.

Stop Losing Money Today

Chioma isn’t dealing with 2:37 AM payment panic anymore. She’s making ₦1.6M monthly with ₦1.55M actually entering her account. She knows exactly who paid. She spends 15 minutes daily on tracking instead of 3 hours. She sleeps peacefully.

Same Chioma. Different system. Different life.

You’re losing about ₦684,000 monthly to payment chaos. That’s ₦8.2M yearly disappearing.

Breally gives you: automatic payment tracking, instant WhatsApp receipts, automatic payment reminders, complete visibility of who paid, cash and transfer tracking in one place, staff recording without money access.

Right now, Nigerian beauty and skincare businesses get 3 months completely free, plus a dedicated account manager for a year.

[LINK: Click here to set up your free Breally account → https://breally.com/signup]

Or WhatsApp us at +234-XXX-XXX-XXXX.

You’re losing money right now. Today. Every hour you delay costs about ₦900 in forgotten payments and wasted time.

Stop accepting payment chaos as “just how business is.” It’s fixable. Starting today.

Your money is waiting to be recovered. Let’s get it back.

Explore other Blog Posts

How to Set Up a FREE E-commerce Website in 2026 (Breally.co)

Building a Powerful Sales Funnel That Converts In 2026 And Beyond

Whatsapp Lead Generation : The Ultimate Guide (2025 Update)

10 Powerful Ways To Automate Your Whatsapp Business Messages In (2024)

15 Whatsapp Marketing Strategies For E-commerce Growth – (Breally.co)

How to Book Demos, Handle Appointments & Schedule Calls on WhatsApp

The Best Ways To Build & Grow A Fashion Business In Nigeria (2026 Update)

How Nigerian Businesses Are Making More Money with Breally in 2025